Blog

Mitigating China Supply Chain Issues in 2024

PUBLISHED ON:

January 15, 2024

Subscribe to Receive the Latest Supply Chain Design Resources

Today, US companies are more hesitant than ever when it comes to manufacturing in China. Ongoing trade tensions push many US companies to re-evaluate supply chains and diversify sourcing options to remain resilient in the face of uncertainty.

Many companies are actively reducing reliance on Chinese manufacturers. The current sentiment toward the supply chain in China is apprehensive at best.

Chinese supply chain risk increased due to the ongoing trade war with the US, the pandemic, and geopolitical upset. Many companies are now looking to countries like India, Mexico, and Vietnam for manufacturing goods. As of July 2023, Census Bureau data indicates Mexico has taken China’s place as America’s top trade partner.

When questioned in the US-China Business Council’s 2023 Member Survey, just 80% of respondents said their China operations were profitable in the previous calendar year.

84% of respondents report that US-China relations have impacted their business in China. In response to these tensions, 31% of respondents are developing new supply chains for China-specific, US-specific, and other region-specific businesses.

China’s supply chain has also taken a hit from recent US government sanctions and export controls, specifically on companies suspected of human rights abuse, intellectual property theft, and threatened national security.

Despite these risks, China is still a key player in the global supply chain, dominating the technology and electronics industry. For now.

In this post, we’re demystifying the Chinese supply chain risks–what they are, how they came to be, and what you can do to build a resilient supply chain that can withstand disruptions.

China supply chain risks to look out for in 2024

Extreme weather and climate regulations

With a whopping Everstream risk score of 100%, extreme weather events are the top logistics disruptor for supply chains heading into 2024.

Back in the 1980s, the U.S. experienced a billion-dollar weather event every four months. Today, the country experiences an event of this magnitude every three weeks.

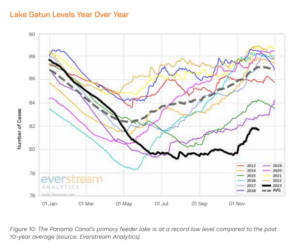

The impacts of the climate crisis are already being felt through the Panama Canal’s worst drought since records began in 1950. The late December dry season means we likely won’t see improvement until at least the fifth month of 2024. Lack of rain in the Panama Canal limits the number of vessels that can cross, forcing ocean carriers to pivot.

As the impact of weather on manufacturing and logistics becomes more apparent, companies will face new environmental regulations. Currently, there are pending mandates that address deforestation, packaging, and chemical use. As new ESG regulations emerge, manufacturers will struggle to update facilities and upgrade equipment.

Consequences of violating environmental regulations include fines, litigation, production stoppages, and plant closures. In 2023, China accounted for 20.83% of these incidents. The only country with more incidents related to environmental violations was the United States, which accounted for 41.67%.

Geopolitical upset

Wars in Ukraine and the Middle East threaten the flow of grains, oil, and consumer goods.

Taiwan will also be a conflict hot spot in 2024. Tensions and regulator friction are on the rise due to Taiwan’s January presidential election. New policies are lined up to limit exports, restrict investments, and prevent the transfer of key technologies to mainland China.

Any escalation of this conflict would harm global supply chains. A Chinese blockage would lower global economic output by $2.7 trillion or 2.8% in the first year alone, with 60% of the economic loss concentrated in China and Taiwan.

This would also decrease China’s global trade by 20% or more, harming electronics, textiles, plastic, rubber, chemicals, and base metal exports. It would cost around $350 billion over three years to replace Taiwan’s semiconductor capacity.

BRICS expansion

BRICS expansion will likely shift geopolitical spheres of influence and trade alliances. Results could include a solidification of Russia/China trade relations.

Potential increasing interactions between China and BRICS members and MEB countries may slow trade with other countries. This would broaden China’s trade portfolio and help safeguard the importance of its supply chain.

Forced Labor in the Uyghur Region

Chinese automotive supply chains are also experiencing scrutiny in connection with forced labor in the Uyghur Region. Chinese government subsidies and incentives attracted the world’s largest steel and aluminum producers to the Uyghur Region. As a result, companies are at risk of unintentionally sourcing metals from this region. To avoid the associated legal, ethical, and reputational risk, the auto industry must trace its supply chains all the way back to raw materials.

The Senate Finance Committee is currently investigating both US and foreign auto manufacturers and suppliers for connection to forced labor in the Uyghur region. According to the Uyghur Forced Labor Prevention Act Congress passed in 2022, goods made in Xinjiang cannot be imported to the United States without proof that no slave labor was involved.

While the supply chain’s complexity makes confirming this extremely difficult, Senator Ron Wyden, Chairman of the chamber’s Finance Committee, says “This complexity cannot cause the United States to Compromise its fundamental commitment to upholding human rights and US law.”

Trade and tariffs

Back in 2018, tariffs on Chinese goods reduced products, raised prices, and increased domestic production. Data on the impact of these tariffs for 2018-2021 shows that:

- Steel imports fell by 24%, with US production increasing by 1.9% and prices rising by 2.4%

- Aluminum imports fell by 31.1%, with US production increasing by 3.6% and prices rising 1.6%

- The value of cut and sew apparel imports fell 39.1%, while the value of US production rose 6.3%

- The value of semiconductor imports and electronic components fell 72.3% and the value of domestic production increased by 6.4%

- Furniture and kitchen cabinet imports fell in value by 25.4% and domestic production value increased by 7.5%

- Vehicle parts imports fell 50.1% by value and domestic production value increased by 3%

The consensus is that despite US steel and aluminum industries benefiting from increased production and prices, the effects were negative for manufacturers purchasing the metals as inputs downstream. For these downstream industries, production fell by nearly 3% (as much as $469 million for some). The tariffs created $1 billion in direct costs for apparel and furniture imports, nearly $800 million in 2022 for travel goods, and over $450 million in 2022 for footwear.

The end of 2023 marks China’s biggest manufacturing slowdown since the COVID-19 pandemic peaked in 2020. This time, the idle capacity is a result of sluggish demand from the US market, not strict anti-COVID policies.

Data from the GEP Global Supply Chain Volatility Index produced by S&P Global and GEP shows rising spare supplier capacity, mainly due to a pullback in global demand. The GEB index also shows a depressed level of demand for raw materials, components, and commodities to match the decreased manufacturing orders.

According to Jon Gold, vice president of supply chain customs policy at the National Retail Federation, Section 301 tariffs and exclusions pose a major challenge for supply chain planning in 2024. “The tariffs contribute to additional costs that retailers are either forced to absorb or pass along to consumers. While many retailers have been looking to diversify their supply chains, it takes significant time to shift sourcing,” said Gold.

As of writing, current exclusions from the China Section 301 investigation tariffs have been extended to May 31, 2024.

CHIPS

China responded to the CHIPS and Science Act of 2022 by announcing a $148 billion package last December, aiming to subsidize the purchase of Chinese equipment and factory construction.

While the CHIPS and Science Act of 2022 originally aimed to support reshoring and bolster America’s supply chains, the Commerce Department’s recent additions stated that subsidy recipients cannot expand semiconductor manufacturing in countries of concern (including China) for 10 years. Because China remains central to the chip industry, this stipulation will likely deter some chip makers from applying for aid in the US. According to the Semiconductor Industry Association, China’s chip sales totaled nearly 40 billion in 2020– that’s 9% of the world market. The total is projected to reach $116 billion (17% of the world market) in 2024.

As the trade war between the U.S. and China continues, companies will be forced to find new technology suppliers to avoid disruptions. 2024 will likely highlight a gap between trade war restrictions and domestic technology investments.

New semiconductor plans may take up to three years to become operational, which will leave many manufacturers scrambling to source high-tech components previously acquired from Chinese suppliers.

Trade route disruptions

We may have just started a new year, but that fresh start doesn’t extend to the Panama and Suez Canals. These two crucial global trade corridors are kicking off the new year facing disruption and geopolitical tensions, forcing some companies to consider redrawing trade maps altogether.

Climate change and mass migration disrupt trade lanes from the Panama Canal to the U.S. border.

Carrier ships are also facing attacks by Yemen-based Houthi rebels as they cross the Suez Canal, likely in retaliation to Israel’s war on Gaza.

Trade route disruptions force ocean carriers to seek alternative routes with longer transit times According to Nathan Strang, Director of Ocean Freight at Forwarder Flexport, prior shipping schedules and rate expectations are now meaningless. Logistics providers must be more flexible than ever in 2024.

Cybersecurity threats and data breaches

Companies, sub-tier suppliers, and logistics providers all became victims of cybercrime throughout the last calendar year. Cyber attacks rose 202% YoY in 2023, breaking the previous record from 2020. Be prepared for ransomware and data breach to become an ongoing issue in 2024.

China’s current economy

The Chinese economy is struggling. In November of 2023, China’s consumer prices dropped at their fastest rate in three years while producer price deflation extended into the 14th month. Imports from China to the U.S. fell by 0.6%— a stark contrast to the 3.3% increase forecasted by Reuters’.

Early December 2023, Moody’s downgraded ratings for China’s government credit and eight largest banks from stable to negative. Moody’s expects China’s fiscal, economic, and industrial strength to suffer from possible bailouts for distressed local governments and state-owned companies.

While discussing the state of China’s economy at the annual Central Economic Work Conference, President Xi Jinping and Chinese Communist Party leaders vowed to continue fortifying supply chains and share that economic security is a top priority amid escalating tensions with the United States over advanced CHIP and other technology. They claim China will meet the government’s yearly growth target of 5%.

Their action plan is as follows:

- Pursue proactive fiscal policy.

- Be flexible with monetary easing while gauging economic strength.

- Promote large capital investments and urge consumer spending.

- Address real estate, local government debt, and smaller financial investment risk to increase economic and societal stability.

- Resolve property crisis by meeting reasonable funding demand of firms, both state-owned and private.

In 2023 Q3, China’s FDI flow turned negative for the first time since 1998. China’s direct investment liabilities in its balance of payments declined by 11.8 billion USD. This shows that more foreign firms are repatriating rather than re-investing China earnings. China’s Ministry of Commerce reported that actuarial use of foreign capital declined by 9.4% YoY between January and October. Overall, it looks like investors are cautious about investing capital into China. But the number of newly registered foreign companies grew by 32.1% YoY, which shows the Chinese government’s initiatives for attracting foreign investment are working.

The “In China, For China” movement has also picked up speed in recent months. Chinese manufacturers are using this strategy to boost domestic demand and consumption.

Despite a decrease in overall foreign investment, increases did occur in a few industries:

- Manufacturing: +1.9% YoY

- Medical equipment and instrument manufacturing: +34.6% YoY

- Equipment manufacturing: +14.8 YoY

China’s shifting demographics

2022 marked the beginning of China’s population decline. Throughout 2023, the Chinese government attempted to reverse the decline through various incentive programs. Additionally, they are addressing risks associated with an aging population by pushing vocational training for a growing population of young, jobless workers.

China supply chain issues resolved

2024 will have its fair share of disruptions, but you can relax your mitigation strategies for two risks that were on high alert last year:

- COVID-19 surges

After the initial surge, China’s strict COVID policies allowed them to keep factories up and running. US companies generally perceived Chinese factories as more reliable than Vietnam, India, and Malaysia throughout the pandemic.

This shifted in April of 2022, due to the Shanghai lockdown. The entire region between Shanghai, Kunshan, and west to Suzhou is an IT manufacturing hub. Harsh and wildly unpredictable government policies, combined with Apple’s recent Foxconn factory complex struggle, resulted in US companies being less confident in Chinese manufacturing than ever.

When the Zero COVID Policy met its abrupt end in 2022, an immediate surge in cases hindered production. One auto parts manufacturer reported a third of workers caught the virus at the same time. December exports dropped by 9.9% YoY and production prices fell by 0.7%. One survey deemed December 2022 the worst contraction in manufacturing activity since the beginning of the pandemic in February 2020.

Overall, China-US trade from January to November 2023 dropped 12.2% YoY. As we enter 2024, it looks like the country is soft-launching COVID-19 testing in airports and hospitals and stepping up COVID-19 and Influenza prevention measures in schools. While precautionary measures are seasonally appropriate, social media rumors spark fear among Chinese citizens that another lockdown may be on the horizon.

Despite the public’s lingering anxiety, COVID-related disruptions likely won’t be a big issue for supply chains in 2024.

- Lunar New Year

Most of China’s 170 million migrant workers only return home for the Lunar New Year holiday. The factories officially close for one week, but often end up closing for more than 14 days. During LNY, millions of workers travel home by train and bus. 2020 supply chain disruptions were partly due to factory workers’ inability to return after visiting their families over LNY.

The good news is that this year’s Chinese New Year disruptions won’t be exacerbated by COVID-19 travel restrictions. Instead, expect typical symptoms of holiday disruptions, including:

- Factory closures

- Smaller workforces

- Increased shipping demand

- Congested ports

- Higher shipping costs and processing times

- A shortage of empty shipping containers

Here’s a play-by-play of how this year’s Chinese New Year (Lunar New Year) disruption will go:

- Factories will slow production in the first weeks of January.

- In the latter half of January, businesses will halt manufacturing and operations and Chinese ports will rush to ship remaining goods.

- Between January 26 and February 9, there will be a mass exodus of workers leaving factories for the holidays. Chinese ports will limit operational capacity.

- Chinese New Year celebrations will occur from February 10-17.

- Operations will gradually return to normal toward the end of February/beginning of March.

Supply Chains Leaving China

“It’s official–the “Great Supply Chain Shift” has begun,” says Greg Schlegel, founder of the Supply Chain Risk Management Consortium (SCRMC). “It’s taken 40 years to migrate low and medium manufacturing capabilities to Asia-PAC countries, due to one key aspect–low labor costs. Shifting the supply chains will take time.”

Over the last year, reshoring and de-risking strategies have produced major changes in the level of dependence global supply chains have on China. In addition to last year’s risks, China’s underperforming economy provides even more reason for supply chain parties to reassess their reliability on Chinese manufacturing.

China’s support of domestic businesses via trade protections, tariffs, subsidies, favorable financing, and investment programs will continue to strain U.S. and European trade partner relations.

Nearshoring trends remain strong in 2024. Importers are still looking to shift production from China to Vietnam, India, Mexico, and other trade partners this year. As of 2023, Mexico officially surpassed China as the United State’s number-one trading partner.

C-Suite conversations are comparing the historical supply chain efficiency to its effectiveness with the goal of identifying whether the cost is worth the risk.

In March of 2023, India outlined a target of $2 trillion in annual exports by 2030. Apple is working to move some production out of China. Major iPhone supplier, Foxconn, is currently working on a large factory presence in Bengaluru, India.

Kearney’s latest Reshoring Index indicates that 96% of CEOs are considering reshoring, have decided to reshore, or are already reshored. Additionally, US imports of manufactured goods from the 14 Asian LCCs and regions tracked by Kearney in 2022 totaled 14.1% of US gross manufacturing output, 14.49% lower than the previous year.

Manufacturing construction spending surged over 80% from August 2022 to August 2023, compared to just 6% for other private, nonresidential building categories.

In 2022, Whirlpool announced a $120 million investment in its Coahuila, Mexico production plant. Bosch Rexroth also announced plans to build a $215 million facility in Queretaro. Toy maker Mattel invested $50 million in its Nuevo Leon plant after closing two factories in Asia and one in Canada. Lego began construction of a $1 billion new factory in Vietnam to serve major markets in the region (India, Indonesia, and the Philippines) announcing their China factory will exclusively serve the China market. Tesla’s plans for a reported $5 billion factory in northern Mexico has even been credited with attracting $1 billion in Chinese investments to nearby industries.

The following companies have also expressed plans to diversify sourcing away from China in response to supply chain risks:

- Dell

- Microsoft

- Hewlett Packard

- Intel

- Amazon

- Cisco

- Nike

- Walmart

Some cite lower costs and proximity to distribution centers as the reason for the change. However, there is a clear pattern of companies building redundancy and resilience into their supply chains.

Other reasons for reshoring include government incentives, affordable automation reducing the need for skilled labor, and ESG expectations.

How to Monitor and Mitigate China’s Supply Chain Risks in 2024

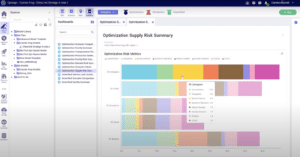

The SCRMC advocates strongly for digitizing the supply chain. This enables modeling the supply chain to run “What-if” risk event scenarios that show how a supply chain will respond before the risk event occurs. Scenarios render risk assessments using techniques like Risk-Priority-Numbering and Value-at-Risk calculations.

According to SCRMC founder Greg Schlegel, “When supply chain modeling tools like Cosmic Frog are exercised, every scenario displays the financial impact of a risk event and potentially a risk assessment. Companies can use this data to develop risk mitigation plans. The SCRM Consortium calls this “Stress-Testing the Supply Chain” and deems it an SCRM exemplary company best practice.”

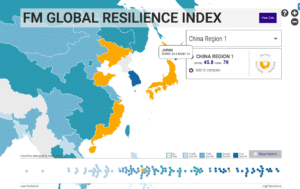

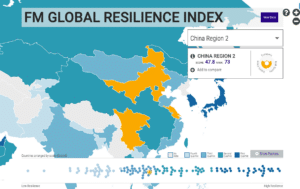

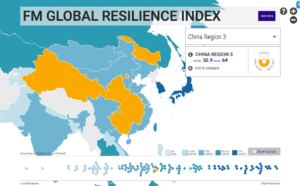

The SCRM Consortium has advocated the use of FM Globals’s Risk and Resilience Country Index. They rate 130 countries and rank their risk and resiliency every six months. The rank is based on three major sectors driven by 15 critical infrastructure indicators and includes an evaluation of the country’s supply chain infrastructure.

Because China is so large, the Index has segmented the country into three sectors. Here’s how they’re ranked according to 2023 data:

- China Region 1: 78

- China Region 2: 73

- China Region 3: 64

Canada is number 22, Mexico is 66, and the United States’ three regions are ranked 7, 14, and 6, respectively.

All three sectors were ranked in the 70s as of 2022. A high rank means low resiliency and increased risk.

Potential China supply chain disruptions to prepare for in 2023 are:

- Natural disasters

- Geopolitical issues

- Cybersecurity threats and data breaches

- Trade conflicts and tariffs

- COVID-19 surges

How to Quantify China Supply Chain Risk in Global Supply Chain Decisions

Identifying risky aspects of your network, understanding the impact of potential disruptions, and creating risk mitigation scenarios is an essential part of creating a resilient supply chain. The Cosmic Frog supply chain design platform is an ideal way to evaluate China sourcing and production and balance trade-offs across a multitude of factors.

What is Cosmic Frog, anyway?

Cosmic Frog is the only supply chain design platform that is 100% SaaS-based and balances cost, service, and risk for more resilient supply chains amid volatility.

Supply chain design technology enables you to evaluate strategic, systemic changes. It does this by creating digital models of the future supply chain to test the impact and performance of multiple alternatives.

Because Cosmic Frog is the only supply chain design solution that offers optimization, simulation, and risk analysis across an end-to-end supply chain in a single platform, you can start making more informed decisions beyond just cost.

Model Your China Exit Strategy Using Cosmic Frog

In this video, we showcase the process of modeling your China exit strategy using Cosmic Frog.

This model answers the question: Should we exit China and if so how do we reduce this dependence while still maintaining production within Asia?

Cosmic Frog models allow you to not only identify existing risks within your supply chain but optimize and simulate various scenarios that could reduce risks going forward. Get side-by-side comparisons of scenarios to visualize the trade-offs across financials, service, risk, and sustainability metrics to make smarter decisions.

Four Ways to Mitigate China Supply Chain Risk

Diversification

Diversify your supplier base by sourcing materials and products from multiple suppliers. Further reduce dependency and lessen the impact of potential disruptions by spreading the suppliers across multiple regions or countries.

Risk assessment

Conduct a comprehensive risk assessment to proactively identify and address potential disruptions using Cosmic Frog.

Collaboration

Collaborating with suppliers and other stakeholders to create contingency plans that reduce the negative impact of predicted disruptions.

Redundancy

Incorporate redundancy by keeping safety stock, identifying alternate transportation routes, and establishing backup suppliers.

Grow Your Knowledge

Rethink Redesign: 8 Things Supply Chain Execs Need to Know in 2024

Discover the essential insights for supply chain executives in 2024 as we delve into the latest trends, innovations, and strategies reshaping the industry. Explore this insightful ebook, authored by Optilogic Founder Don Hicks and Maria Villablanca, founder of Villablanca Consulting and Future Insights Network and Co-founder of Transform Talks Podcast.

Optilogic Hosts OptiCon 2024: The Supply Chain Design Design Event of the Year

The leading supply chain design software innovator Optilogic announces its annual user conference, OptiCon 2024, featuring supply chain design solution training, focused breakout sessions and customer case studies from industry giants Coca-Cola, Gerdau, and Whirlpool.

How Supply Chain Design Addresses the Global Impacts of Port Congestion

Explore how supply chain design tackles the pressing issue of global port congestion, delving into strategies, technologies, and innovations that optimize logistical pathways, mitigate disruptions, and ensure smooth operations in the face of evolving challenges.